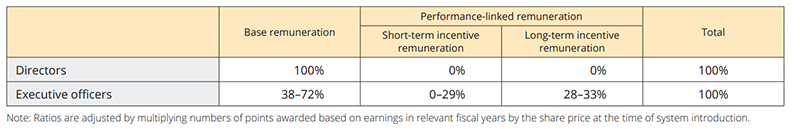

• Directors

Basic Concept

The Kurita Group aims to contribute broadly to society through corporate activities in the fields of water and the environment in accordance with the Kurita corporate philosophy, “Study the properties of water, master them, and we will create an environment in which nature and humanity are in harmony.” The Kurita Group will work to promote sustainable growth and enhance its corporate value in the medium and long term, deferring to the rights and positions of various stakeholders such as customers, business partners, employees, shareholders, and local communities while striving to meet their expectations. To this end, the Kurita Group is working to establish corporate governance, with the aim of realizing transparent, fair, prompt, and decisive decision-making and highly effective management supervision.

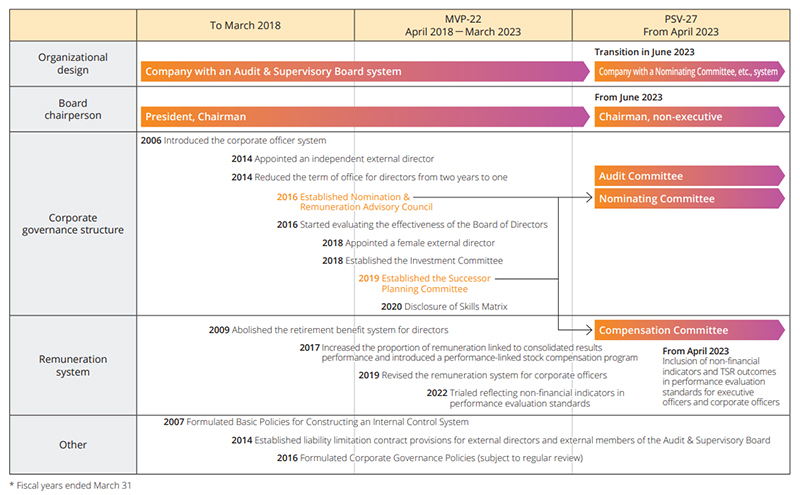

Timeline of Corporate Governance Improvements

The Kurita Group has sought to develop its governance structure to ensure that it fulfils its social obligations as a global enterprise while continuing to grow. Going forward, to ensure the Board of Directors can maintain the highest level of functionality, the Group will seek to build an optimized corporate governance set-up by reinforcing governance through appropriate review and adjustment.

Nomination of directors and selection of successor candidates

Policies and procedures for nominating directors

The process of selecting candidates for external and other directors is designed to give due consideration to diversity while creating a system of management oversight that enhances corporate value and reflects the perspectives of shareholders and other stakeholders. Nomination of candidates for director is based on predetermined requirements. The Nominating Committee selects candidates for recommendation to the General Meeting of Shareholders, including a clear rationale for each.

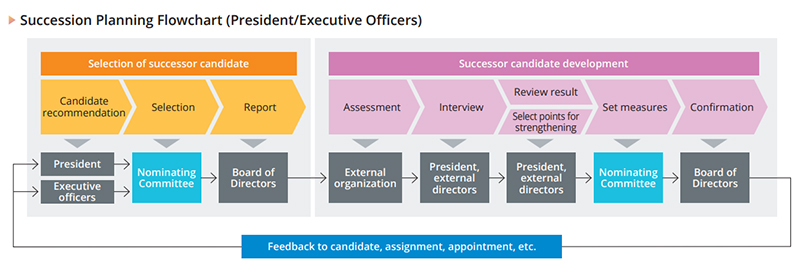

Selection of candidates for the successor to the President and Executive Officer and succession planning policies

The Nominating Committee will deliberate on requirements for the President and Executive Officer in light of the aims of the Company and specific management strategies and then report the results to the Board of Directors. The Nominating Committee will select multiple candidates for the successor to the President and Executive Officer and develop succession planning measures based on requirements set forth by the Board of Directors. The Board of Directors will regularly confirm the selection of candidates for the successor to the President and Executive Officer, development of the succession planning measures, and its progress based on reports from the Nominating Committee.

Succession planning process

The Nominating Committee selects the candidates for president and executive officer positions and formulates development measures as delegated by the Board of Directors. Selection and development are the result of a highly objective and transparent process that includes taking into consideration the results of assessments of each candidate by an external evaluation body.

Determining Remuneration for Directors and Executive Officers

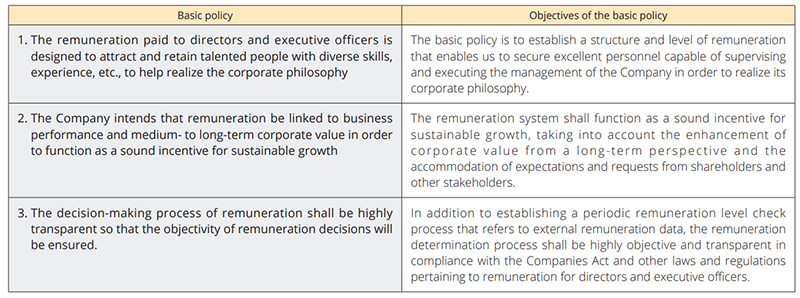

Basic Policy on Determining Remuneration for Directors and Executive Officers

System of executive remuneration

The policies relating to remuneration amounts and calculation methods for directors and executive officers are determined for each position in line with the Group's relevant basic remuneration policy.

With the aim of increasing the objectivity and transparency of related decision-making processes, the structure and levels of remuneration for directors and executive officers as well as the performance evaluation of executive officers are determined by the Compensation Committee, with related status updates promptly reported to the Board of Directors.

To facilitate a core focus on management supervision, the remuneration of directors is limited to a fixed salary. The fixed remuneration is determined by position for directors, except for directors who also serve on the Audit Committee, whose level of remuneration is linked to the nature of the contractual working arrangement.

In addition, for directors to share the risk of share price fluctuations with shareholders, a portion of the fixed remuneration for directors (excluding external directors and those directors serving on the Audit Committee) is paid in the form of non-performance-linked stock. For external directors and directors who serve on the Audit Committee, a portion of the fixed remuneration is contributed to the Directors' Shareholding Scheme, which is used to acquire Company shares. For directors who are not external directors or directors serving on the Audit Committee, the Company has introduced a non-performance-linked stock compensation plan in which points are awarded according to job position and annual distributions of restricted stock are made based on the number of points awarded.

• Executive officers

Remuneration of executive officers is composed of a fixed salary based on job position plus a performance-linked portion split into short-term and long-term incentive components. The short-term incentive consists of four amounts based on: consolidated performance; the performance of operations over which executive officers have individual responsibility; metrics for other contributions; and the environmental impact coefficient. The metric used for consolidated performance is the year-on-year change in ROIC. For operational earnings, the metric used is the variance between the consolidated operating profit margin and business profit margin for the executive officer's divisions and their respective targets. Other contributions are evaluated with reference to items not reflected in the fiscal year's results such as initiatives to strengthen the corporate structure and implementation of M&A and other large-scale investment projects. The environmental impact coefficient which is designed to create corporate value through social value creation, is calculated based on the percentage achievement of the plan for each metric measured within the CSV business (amounts of water savings, avoid in GHG emissions, and amounts of resource recovery or reduction of resource input). The short-term incentive is then calculated by taking a base amount determined by job position and applying to it a multiplication rate proportional to the degree of attainment indicated by the results metrics and the environmental impact coefficient. The long-term incentive comprises a performance-linked stock compensation program in which points are awarded according to job position and based on ROE and total shareholder return (TSR) for each fiscal year during the term of office, with annual distributions of restricted stock being made according to the number of points awarded. This remuneration is subject to the determination of the Compensation Committee, with related status updates promptly reported to the Board of Directors.

Auditing set-up

The Audit Committee is composed of three directors (of whom two are external directors) with no involvement in operational execution across the Company or its subsidiaries. One of the external directors serves as the chair. To ensure a high degree of independence from operational execution, two of the Audit Committee members serve as full-time corporate auditors (including one external director). Based on their unique position, the full-time corporate auditors can focus on preparing conditions for internal audits and actively collecting internal information, while conducting daily monitoring of the development and operational status of the internal control systems.

The Company has created a dedicated secretariat to assist members of the Audit Committee in their duties, staffed by full-time employees. If required, the Audit Committee may also request additional assistance from employees assigned to the Internal Auditing Department, which manages the Company's internal controls.

Auditing by Audit & Supervisory Board members in the fiscal year ended March 31, 2023

All Audit & Supervisory Board members attended the 11 meetings of the Audit & Supervisory Board held in the fiscal year ended March 31, 2023. The main matters discussed by the Audit & Supervisory Board included the formulation of audit policies and plans, preparation of audit reports, the election of the accounting auditor and related remuneration, and agenda items for the Ordinary General Meeting of Shareholders. Within audit plans, priority items for audit are the construction and operational status of internal control systems (including those relating to financial reporting) and risk management systems, and the status of priority measures in the business plan.

The Kurita Group's governance system for the fiscal year ended March 31, 2023 was that of a company with an Audit & Supervisory Board. This changed to the system of a company with a Nominating Committee, etc., after the approval of the Ordinary General Meeting of Shareholders held on June 29, 2023.

Dialogue with Shareholders and Investors

The Kurita Group respects the interests of shareholders in management and strives to listen to its shareholders and investors and promote constructive dialogue with them in order to contribute to increasing medium- to long-term corporate value. In communicating information, the Company emphasizes fairness and transparency. The materials and summary of the Q&A sessions of the Company's presentation meetings are posted on Kurita's investor relations website to ensure fair information disclosure.

To make IR disclosures more convenient for shareholders, the Group also publishes English translations of the Notice of Convocation of the General Meeting of Shareholders (including advance notification prior to the sending of this notice) and the Corporate Governance Report.

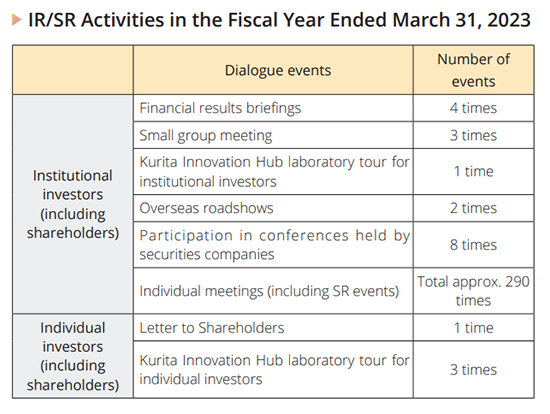

Investor and shareholder relations activities

The Group strives to secure opportunities for dialogue with institutional investors in Japan and overseas and with retail investors in Japan in the form of various presentations and briefings. For financial results briefings, the president and the executive general manager of the Corporate Control and Administration Division are the main speakers, while day-to-day communications are the responsibility of the executive general manager of the Corporate Control and Administration Division and are carried out in coordination between personnel assigned to investor and shareholder relations and staff responsible for ESG activities. The use of teleconferences and online meetings for dialogue with institutional investors continued even after the downgrade of the COVID pandemic to Class 5, the same category as influenza. Kurita also received more visits from overseas investors and conducted more overseas roadshows to meet directly with investors. In addition, SR activities continued, mainly in the form of sustainability initiatives and meetings with shareholders on the topic of corporate governance. A total of approximately 290 separate IR/SR meetings were held in the fiscal year ended March 31, 2023. We also organized laboratory tours for both institutional and retail investors on R&D and innovation at the Kurita Innovation Hub, which was established in April 2022.

The views and expectations gained from dialogues with shareholders and investors are provided promptly as feedback to various layers of management, including directors, to help inform improvements to the Group's management, disclosures and other activities.

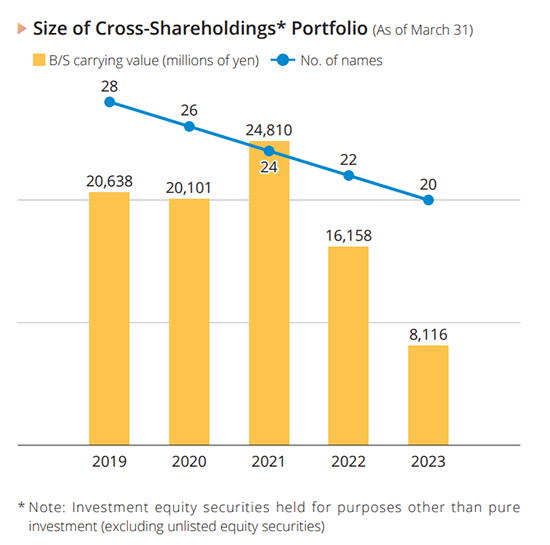

Shareholdings of Other Listed Companies

The Company holds shares of other listed companies to strengthen business relationships. We verify the economic rationale for mutual shareholdings and examine relationships with companies whose shares the Company holds based on our transaction history. The Board of Directors conducts periodic reviews of the appropriateness of Kurita's cross-shareholdings and is looking to cut the number of such shares held. As of March 31, 2023, compared with four years earlier, the total cross-shareholdings portfolio had shrunk by about 30% in terms of the number of names and by about 60% in terms of the carrying value as stated on the balance sheet.

Cross-shareholdings policy

- •In some cases, the Company holds shares of other listed companies to strengthen business relationships, etc.

- •When holding such shares, the Company makes efforts to minimize the risk of holding the shares. The rationale for holding each stock is reviewed on a regular or timely basis by the Board of Directors. Based on the results of the examination, the Company works to reduce the holding of shares of other listed companies.

- •The Company exercises voting rights for each proposal based on whether it will contribute to an increase in shareholder value.

- •If a shareholder indicates its intention to sell the Company's shares, the Company will not prevent the shareholder from making such sale, etc.